Some links may be affiliate links. We get money if you buy something or take an action after clicking one of these links on our site.

Christmas All The Time is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. As an Amazon Associate, I earn from qualifying purchases.

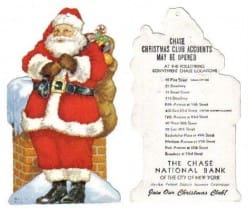

Christmas Club Savings Account

What is a Christmas Club Savings Account?

A standard Christmas Club Savings Account is a short term savings account in which the account holder deposits a pre-determined sum on a regular basis for a fixed period typically maturing at Christmastime. Penalties for early withdrawal are customary in order to encourage saving the money for Christmas shopping. Interest paid on the accounts varies from institution to institution.

History

The first known Christmas club began in 1909, when the treasurer of the Carlisle Trust Company, Merkel Landis, introduced the first Christmas savings fund in Carlisle Pennsylvania. The club grew to 350 customers who saved approximately $28 each. Their money was disbursed on December 1 to facilitate their Christmas shopping.

How Do I Start a Christmas Club Savings Account?

Check with the banks that you do your business to see if they offer a Christmas Club Savings Account. None of the banks I currently do business with are advertising any sort of Christmas Club on their websites and according to the Credit Union National Association, at least 72% of credit unions offer this service. It has also been reported that some retailers are offering a Christmas Club of sorts, except that the money put aside will be spent only at that establishment like an in-store credit that you would get when right-sizing your own Christmas presents. If your bank or credit union does have a Christmas Club Savings Account plan, many will accept direct deposit from your paycheck if you have the option to portion out your pay upon request. Check with your HR department for policies on such disbursements. As an alternative to opening a Christmas Club Savings Account, you might consider flipping some of your tax return (I hope you’re getting some back instead of having to pay in!) into a short term CD. For instance, PNC Bank offers a 3 month CD with a minimum deposit of $1,000. You could let this mature and renew twice and begin shopping in September or thrice and get that extra bit of interest to fuel your joyous yuletide goody grabbing in December.

Does the Christmas Club Savings Account Have a Future?

Saving money is an evergreen proposition. Whether you use a specialized account such as this or retail layaway or CD’s or even a plain old piggy bank, it’s a good deal more sensible to save early and add to the pot often than it is to pay for your gifts with credit cards. To avoid the holiday hangover that comes from an avalanche of credit card debt, you just need to make a plan and stick to it. How much are you going to spend and how soon do you have to start saving in order to meet all of your yuletide needs? Only you and Santa know the answer to that.

1 Reply to “Christmas Club Savings Account”

Comments are closed.